Market Update for Florida Homebuyers: Interest Rates Could Drop as Job Market Cools

Market Update for Florida Homebuyers: Interest Rates Could Drop as Job Market Cools

September 9, 2025

Researched and Written By Richard Eimers, Broker for Beach Road Realty

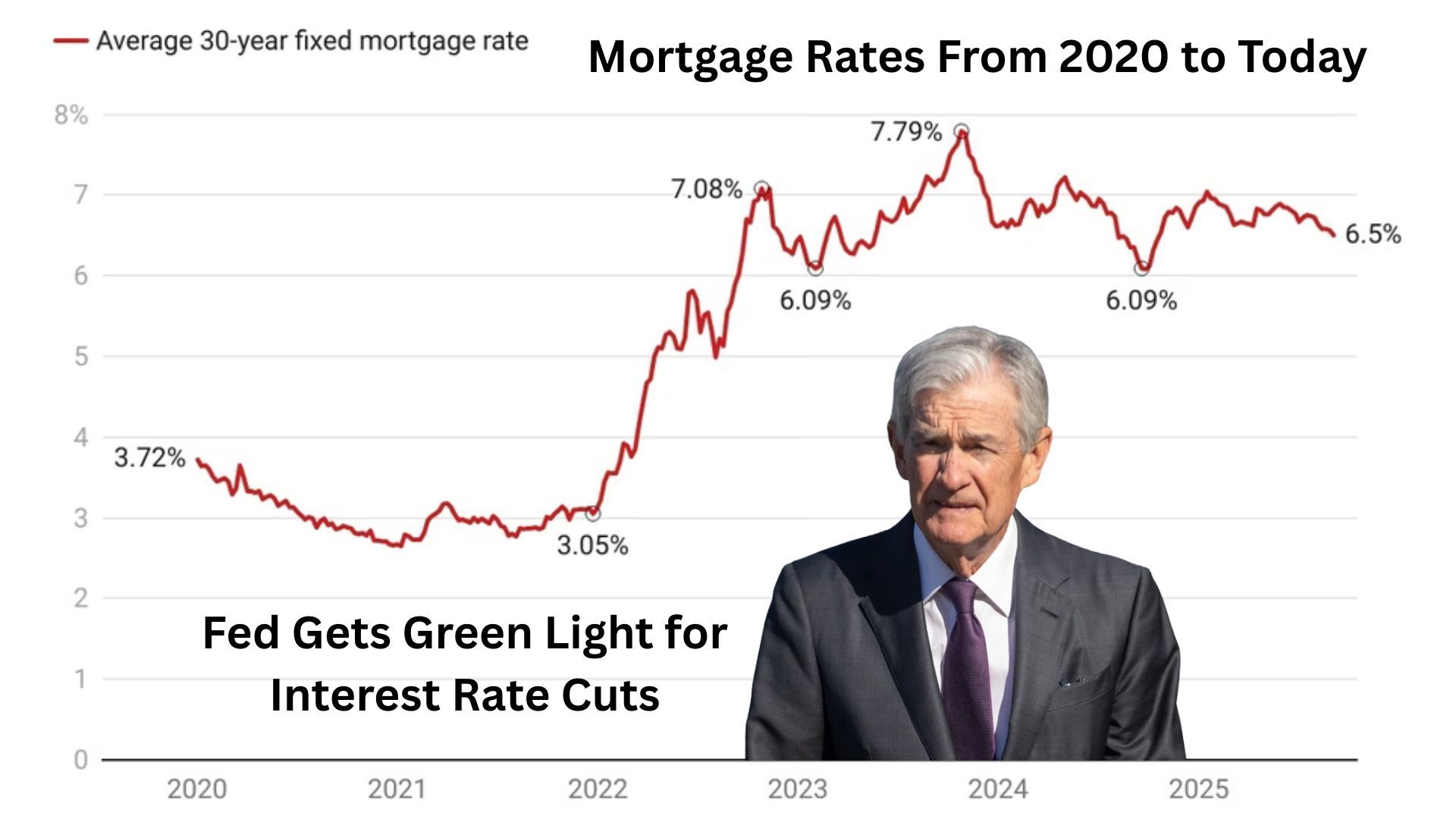

The latest jobs report just shook the market: U.S. unemployment has climbed to 4.3%, the highest in four years, and job growth in August fell short of expectations. While this signals economic slowdown, it could bring good news for mortgage rates.

📉 Lower job growth = Higher chance of interest rate cuts.

The bond market has already responded, pushing 10-year Treasury yields down — a key indicator that mortgage rates may ease further in the coming weeks. In fact, the average 30-year mortgage has already dropped to around 6.5%, the lowest in almost a year.

🏡 What this means for buyers and sellers in Florida:

- Buyers: Now is a smart time to explore options. More inventory, motivated sellers, and improving mortgage rates can work in your favor.

- Sellers: Be ready to negotiate. The market is shifting from ultra-competitive to more balanced—pricing realistically is key.

💡 Don’t wait to time the market perfectly. If you’re financially ready, this could be your moment to act.

Want to talk strategy or run the numbers for your area? Let’s connect—I’m here to help you make the most informed move.

Recent Posts

Market Update for Florida Homebuyers: Interest Rates Could Drop as Job Market Cools

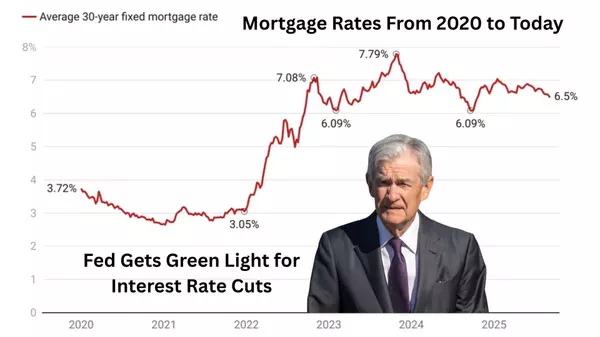

AS A 19 YEAR CYCLE ENDS A NEW CYCLE BEGINS

THE IMPACT OF ECONOMIC SHIFTS ON RESORT REAL ESTATE IN FLORIDA'S EMERALD COAST

Destin, Santa Rosa Beach, and Inlet Beach Resort Markets: The 2025 Window of Opportunity

NAVIGATING THE SHIFTING SANDS: REAL ESTATE TRENDS IN DESTIN, 30A, AND BEYOND (2013-2025)

Preparing to Sell Your Home: A Comprehensive Guide

The Grove By The Sea Gulf Side Neighborhood

Discover Inlet Beach, Florida: Your Ultimate Guide to Coastal Living

Discover Grayton Beach, Florida: A Coastal Paradise

How to Use Virtual Tours to Attract Buyers