In a world where headlines swing from inflation fears to cryptocurrency booms, one question keeps coming up:

Should you put your dollars into digital assets like Bitcoin — or into something tangible like real estate?

As a broker with 30 years of experience in the Destin, Miramar Beach, 30A, and Inlet Beach markets, I’ve watched every cycle — recessions, recoveries, crypto spikes, and housing surges. The question isn’t just about returns. It’s about stability and long-term value.

The Challenge: A Volatile Dollar

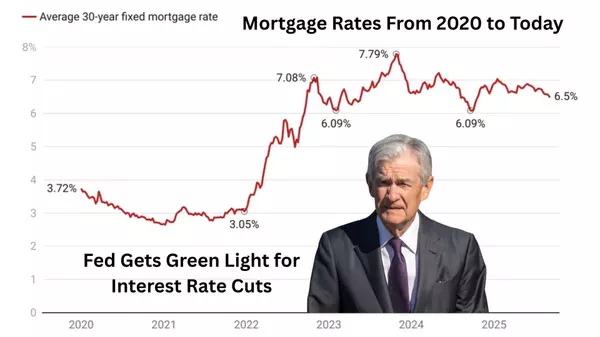

The U.S. dollar’s buying power continues to fluctuate. Inflation, national debt, and global uncertainty have all taken their toll. That’s why more investors are looking for ways to preserve and grow wealth outside of traditional cash holdings.

Digital currencies like Bitcoin and Ethereum offer decentralization and innovation — and yes, the thrill of rapid growth. But they’re also highly speculative. Prices can swing wildly overnight, and there’s no intrinsic income stream behind them.

The Advantage: Real Property, Real Income

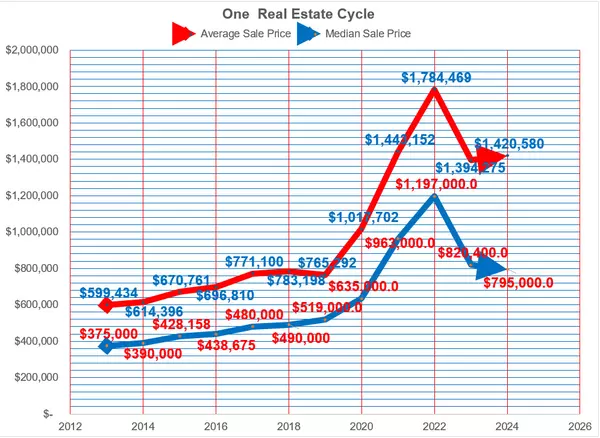

Vacation rentals and second homes along Florida’s Emerald Coast tell a very different story. These are appreciating assets backed by something real — land, structure, and location. While cryptocurrencies can only promise paper gains, resort properties deliver two powerful benefits:

-

Appreciation – Beachfront property remains limited and in demand.

-

Cash Flow – Properly managed, vacation rentals generate consistent income, offsetting costs and building equity over time.

You can enjoy your property, rent it out, or pass it on — all while it grows in value and hedges against inflation.

Digital vs. Real: Finding the Right Balance

There’s nothing wrong with owning a little crypto for diversification. But if you’re aiming for long-term, dependable wealth, it’s hard to beat bricks, mortar, and a view of the Gulf.

When economic uncertainty hits, people still want something they can see, touch, and walk through.

That’s why real estate continues to outperform as a hedge against inflation — and as a lifestyle investment that delivers joy as well as returns.

Final Thoughts

Whether you’re a first-time investor or building your next portfolio of vacation homes, converting your dollars into appreciating, income-producing assets can provide real financial security.

If you’d like to explore available resort properties or learn more about income potential in our area, visit DestinRealEstate.com or call me directly at 850-259-1798.

Real property. Real returns. Real peace of mind.